A card built with millennials in mind

Client

Zilch

Platforms

Web, Mobile

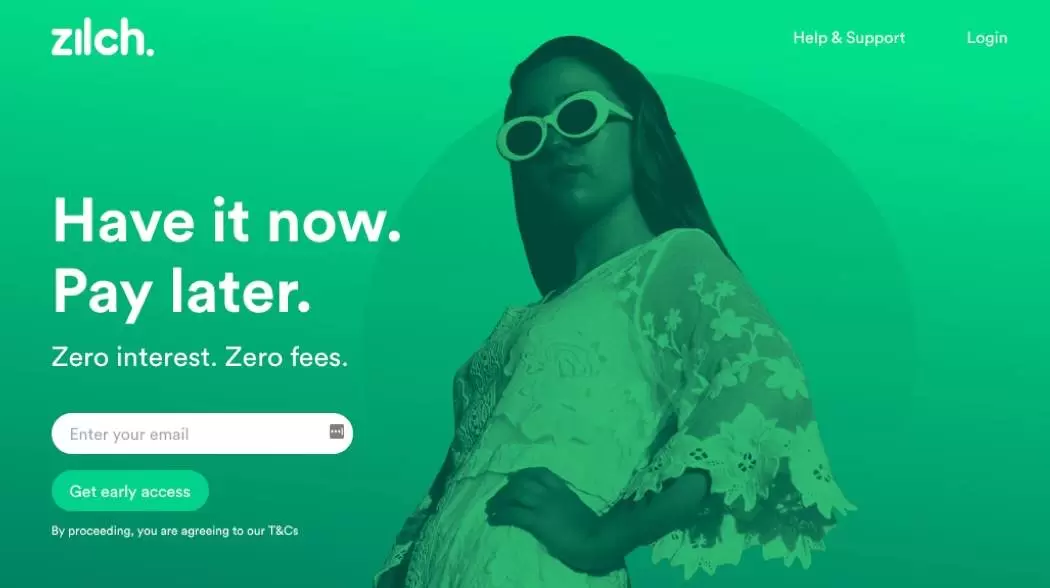

Pay Zilch is a digital wallet designed specifically for millennials that offers the Zilch Mastercard and easy repayment via a customer’s automatically linked debit card. The 44,000 UK merchants who support the card can also target customers using a cost-effective CPA (cost per acquisition) model.

Challenge

To achieve Pay Zilch’s ambitious launch plans, Innovify was tasked with building a digital wallet (through a web app) from scratch. The timeframe for the project was extremely tight, approximately four months from briefing to project completion.

As well as delivering the web app, Innovify had to hit several best practice and compliance targets:

- A real-world Transaction Processing Time of under 250 milliseconds.

- PCI – DSS compliance to reassure customers with the highest level of security and data protection.

- Unpick a mass of third-party dependencies, with poor API documentation (making straightforward integration with other solutions virtually impossible).

Key Objectives

- Deliver project within 4 months

- As with anything within the finance sector, security and data compliance was paramount

- App had to be PCI-DSS compliant as well as gain FCA approval

- Achieve Transaction Processing Time of under 250 milliseconds

Solution

Innovify’s first step was to fully define the scope of the project by executing a discovery workshop with key stakeholders. This mapped out the complex project, informing Innovify’s strategy, and predicting challenges. After this, an expert software SWAT team was assembled, who worked closely with Pay Zilch and Innovify’s Delivery Manager and Tech Lead to keep project timings on-track.

To achieve the rapid Transaction Processing Time, Innovify had to refine Pay Zilch’s existing technical architecture in AWS cloud (Amazon Web Services) and optimise its database. The team used a serverless microservices architecture to minimize downtime for customers and enhance iterative improvement.

The disparate API integrations were tackled through close collaboration with third-party providers. Notably, integrations with GPS, Xero, and CashFlows were required.

Innovify systematically worked through every integration, reading up on (and testing) each one to understand if the APIs would support everything the web app needed to do. After testing, any blockages were rectified with relevant parties. Innovify taking the lead with these integrations meant that major third-party tools were connected to the web app by the deadline date and didn’t cause delays.

Technology used

Results

PCI-DSS compliance was achieved, along with FCA approval, meaning that the web app can be launched to consumers without delay.

Through Innovify’s expertise and approach, Pay Zilch has its digital wallet ready for launch. Complete with all compliance requirements, integrations, and back-end infrastructure. The product is expected to launch imminently.

Most importantly, the project was delivered within the four-month period. All of Pay Zilch’s objectives were met, including the third-party integrations and Transaction Processing Time of under 250 milliseconds.

PCI-DSS compliance was achieved, along with FCA approval, meaning that the web app can be launched to consumers without delay.

Through Innovify’s expertise and approach, Pay Zilch has its digital wallet ready for launch. Complete with all compliance requirements, integrations, and back-end infrastructure. The product is expected to launch imminently.