AI/ML

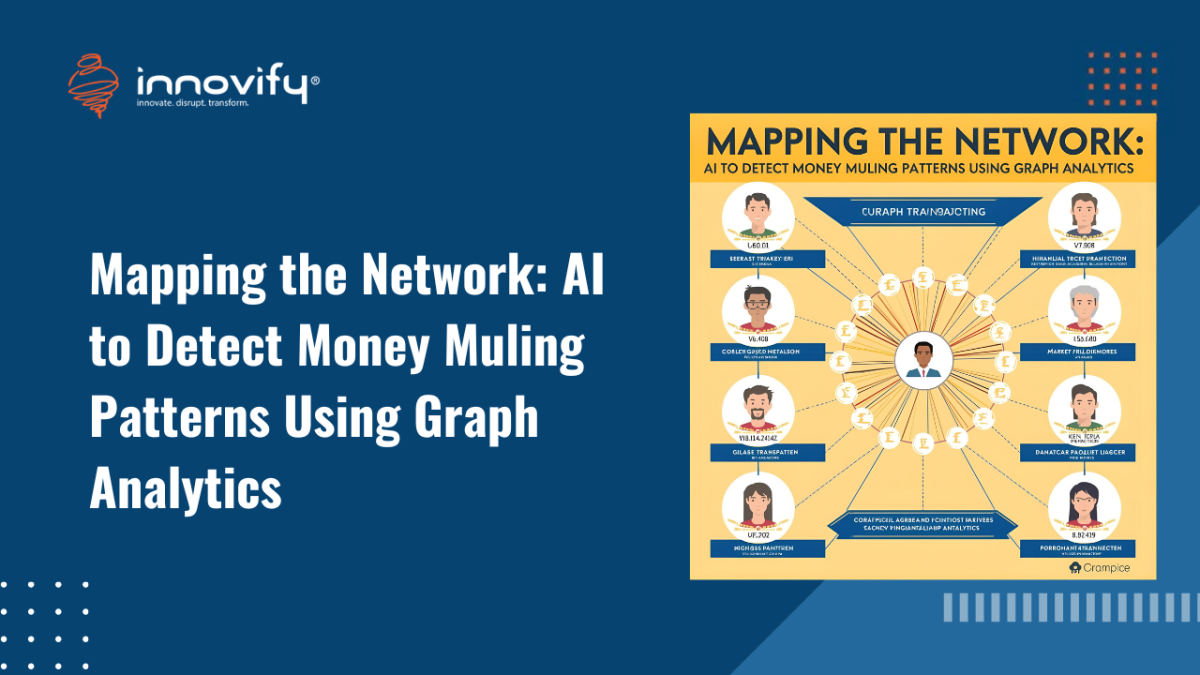

Mapping the Network: AI to Detect Money Muling Patterns Using Graph Analytics

AI to detect money muling patterns using graph analytics

Money mules are the foot soldiers of the global money laundering ecosystem. They are individuals – sometimes complicit criminals, often unwitting victims of romance scams or work-from-home schemes – who allow their bank accounts to be used to transfer illicit funds. By moving money through these intermediate accounts, criminals break the audit trail between the source of the dirty money and its destination. Detecting money mules is notoriously difficult using traditional monitoring because their individual accounts often look legitimate. They may have real IDs, pass KYC checks, and seemingly normal transaction histories. Criminality lies not in the account itself, but in its connections to other accounts. This is a network problem and solving it requires AI to detect money muling patterns using graph analytics.

The Anatomy of a Mule Network

Mule networks are rarely random; they follow specific structural patterns designed to move money quickly and obscure its origin. Graph analytics move beyond analyzing rows and columns of data to analyzing nodes (accounts, entities) and edges (transactions, shared attributes).

- Fan-In / Fan-Out: A common typology involves multiple victim accounts transferring small amounts to a single mule account (Fan-In), which then aggregates the funds and transfers a large lump sum to a “controller” account (Fan-Out). A spreadsheet view of transactions struggles to see this, but a graph visualization reveals the “star” shape of this activity immediately.

- The “Clean” Profile: Mules are often recruited specifically because they have “clean” banking histories (e.g., students, retirees). A rule-based system looking for “high-risk customers” will miss them entirely because their individual risk score is low. It is only their position in the transaction web that reveals their role.

Graph Analytics Techniques for Detection

To catch these networks, FinTech’s employ Graph Neural Networks (GNNs) and graph database algorithms that treat the entire financial ecosystem as a connected web.

1. Community Detection Algorithms

Algorithms like Louvain or Weakly Connected Components (WCC) are used to identify clusters or “communities” of accounts that interact with each other more frequently than with the rest of the network.

- Identifying Fraud Rings: In a legitimate banking ecosystem, most customers don’t transact in tight, isolated loops with strangers. If the algorithm detects a dense cluster of accounts that are rapidly cycling money between themselves, it is a strong indicator of a mule ring or a layering scheme.

- Shared Attribute Linkage: The graph isn’t just built on money flow. It also links accounts based on shared non-financial attributes, such as using the same device ID, IP address, or even sharing a physical address. If 50 seemingly unrelated “student” accounts are all accessed from the same IP address in a different country, the graph reveals this as a coordinated mule farm immediately.

2. Centrality Measures and Flow Analysis

Centrality algorithms (like PageRank or Betweenness Centrality) measure the importance or influence of a node within the network.

- Finding the Controller: A mule account often acts as a bridge or hub. High “Betweenness Centrality” identifies accounts that sit on the critical paths of money flow, acting as bridges between different clusters. These are often the “herder” or “controller” accounts for managing the mules.

- Flow Cycles: Graph algorithms can detect circular loops (Account A -> B -> C -> A), a classic layering technique used to confuse auditors. While difficult to query in SQL, a cycle detection algorithm finds these patterns instantly in a graph database.

Operationalizing Graph AI

Implementing graph analytics requires a shift in data infrastructure. Traditional relational databases (SQL) are poor at handling deep relationship queries (requiring expensive JOIN operations). FinTech’s are increasingly adopting graph databases (like Neo4j or Tiger Graph) to store transaction data as a network, allowing for real-time traversal of millions of connections.

The ultimate goal is real-time interdiction. When a new transfer is initiated, the AI queries the graph: Does this recipient belong to a known mule community? Is this transaction part of a ‘Fan-In’ pattern? The system can then block the transaction before the funds leave the bank. By mapping the network, AI transforms the hunt for money mules from a game of “whack-a-mole” into a strategic dismantling of criminal infrastructure.

Ready to implement graph analytics for fraud detection? Connect with Innovify’s AI experts.